How to automate deferred revenue reconciliation

Getting a complete picture of the order-to-cash processes usually requires stitching together multiple data sources paired with tedious spreadsheet reconciliation work—making it very difficult to get a quick, accurate understanding on why operational revenue doesn’t match what’s appearing on the P&L.

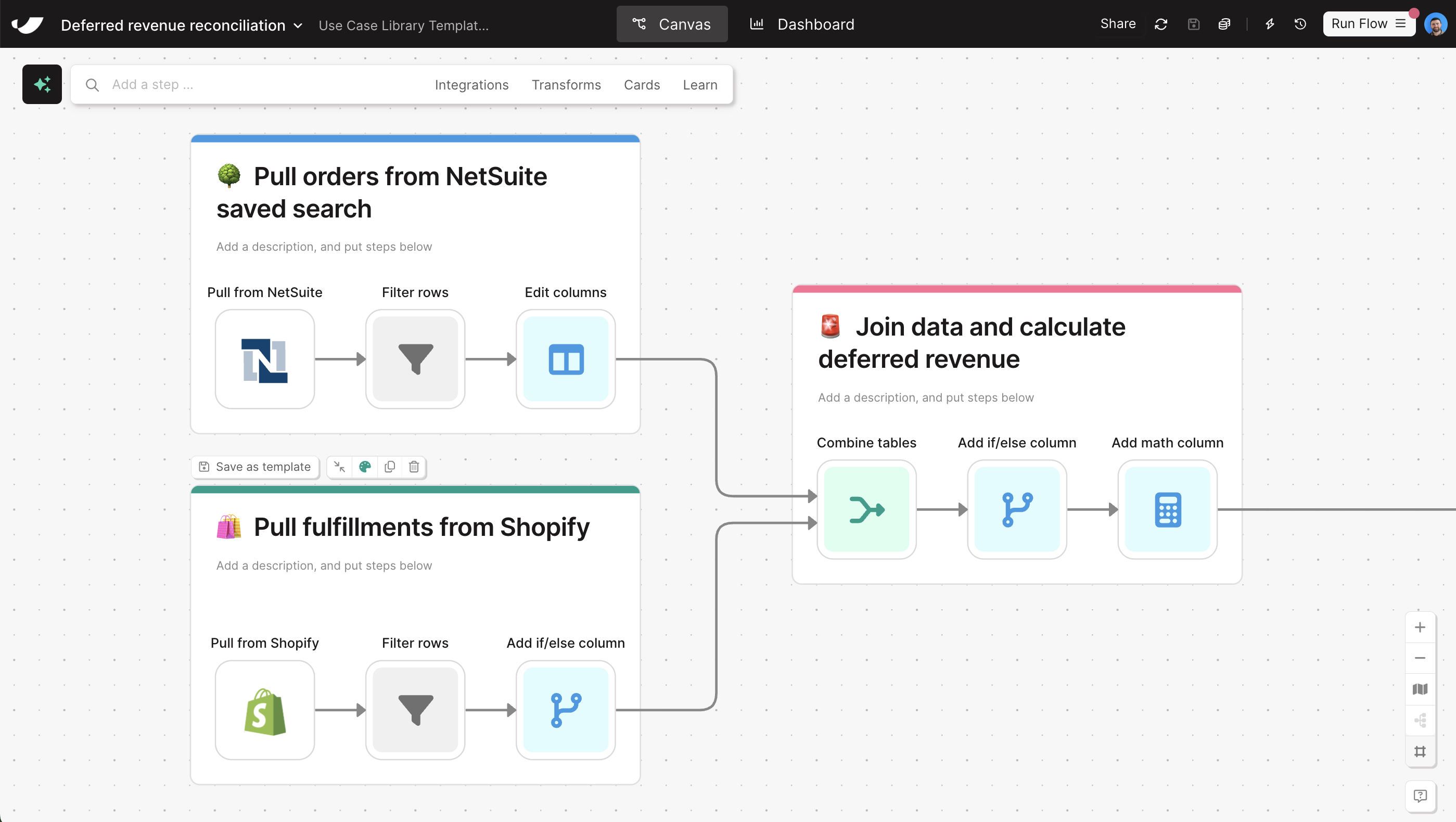

With Parabola, you can pull in deposits, sales orders, invoices, and fulfillment data to unify your order-to-cash process, calculate deferred revenue, and identify gaps in your process. Instantly report on orders that have been placed but not fulfilled and set up alerts for exceptions like missing invoices.

Video overview

Why Parabola

Parabola takes away the boring, low-value work so we can focus on what actually matters. It’s faster, more accurate, and honestly—less soul-crushing.

What is deferred revenue reconciliation?

Deferred revenue reconciliation is the process of matching collected customer payments to revenue recognition triggers—such as item fulfillments and invoices—in accordance with accrual accounting rules. For eCommerce brands, this often means ensuring that what’s recorded as a sale in Shopify is properly reflected in your ERP, and that timing mismatches—especially around end-of-month cutoffs or wholesale orders on hold—are clearly accounted for. Automating this process helps avoid revenue misstatements, surfaces operational delays, and gives finance teams accurate snapshots of liabilities sitting on the balance sheet.

How to do deferred revenue reconciliation in Parabola

- Pull in relevant datasets including order, deposit, and fulfillment data using steps like Pull from NetSuite.

- Clean data using steps like Edit columns, Filter rows, and Custom transform

- Join datasets using the Combine tables step

- Use steps like Custom transform, Add math column, and Add if/else column to identify and aggregate deferred vs. recognized revenue

- Build a reporting dashboard with visualizations using the Visualize step

- Export data using steps like Generate a CSV file or Email a file attachment

Tips for reconciling deferred revenue in Parabola

- Use column renaming and standardization steps early in your flow to align NetSuite and Shopify field names for easier joins.

- Build timestamp filters or snapshot tables to track how deferred revenue evolves over time, especially helpful for identifying aged B2B orders that haven’t shipped.

- Create separate logic flags for known exceptions like gift cards and canceled orders to avoid false positives.

- Consider a Group by and aggregation step to summarize deferred revenue by channel, order age, or fulfillment status.

- Store historical flow outputs in a Parabola Table to create trending dashboards or support ad hoc audit requests.

What other resources are available on deferred revenue reconciliation?

- To start building your own deferred revenue reconciliation flow, check out Parabola University.